Exclusive Access.

Exceptional Returns.

Exceptional Returns.

Gain early access to high-growth private companies. AltMoney Vault gives you early access to limited high-growth companies before they go public.

Get early access to India’s

top private companies.

Get early access to India’s top private companies.

Explore and enjoy early access to high-potential unlisted shares. The best opportunities don't wait. Big moves, bigger rewards. AltMoney Vault is for the bold. Are you?

How to buy

Unlisted Shares

You already understand the value of early access. We just make the process sharper, faster.

-

Browse

Opportunities

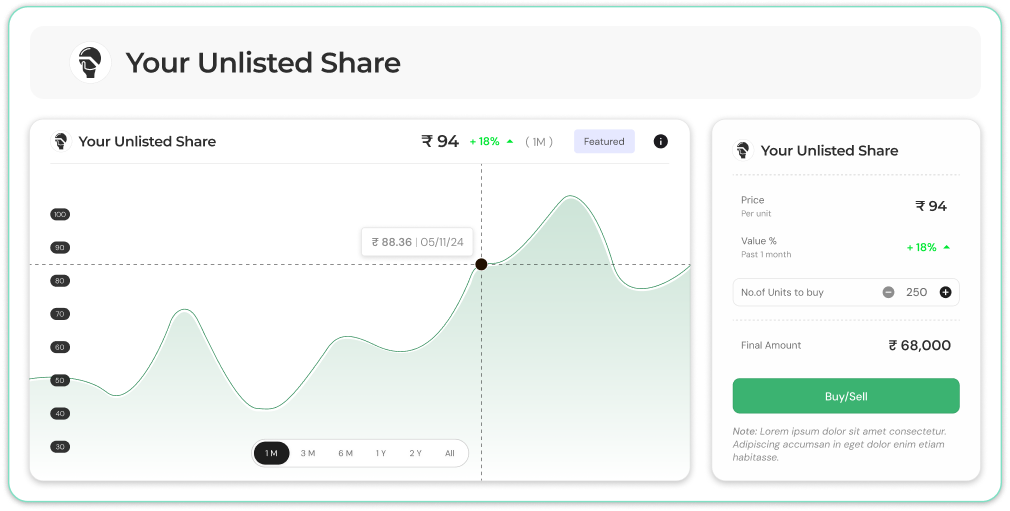

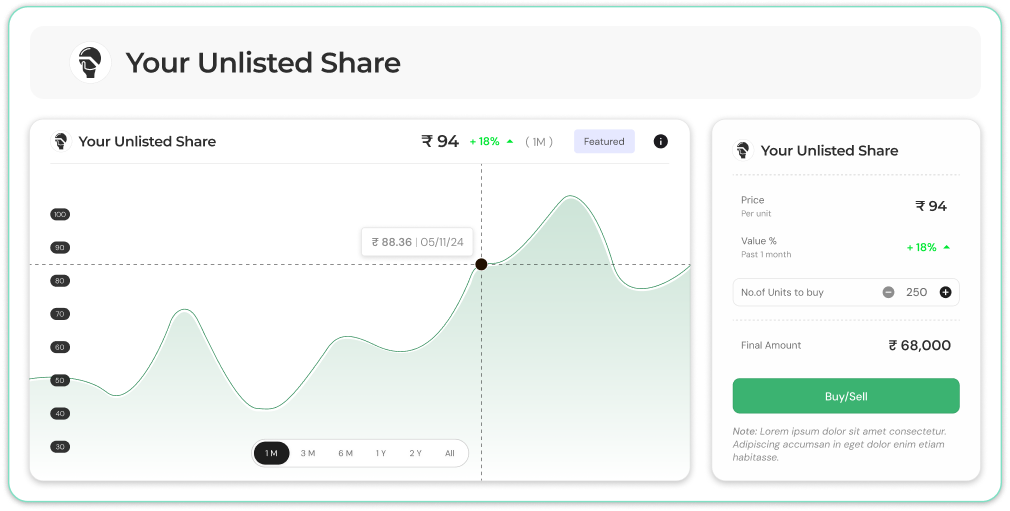

Explore handpicked, high-potential companies. No clutter - just quality deals backed by research and insight.

Choose & Confirm

Pick your investment amount and hit the buy/sell button to raise an enquiry. Our Relationship Manager will guide you through the next steps.

Complete the Deal

Once KYC and payment is done, your shares are transferred securely to your Demat account-usually within 1 business day.

They talk about timing - you just nailed it!

How to buy

Unlisted Shares

You already understand the value of early access. We just make the process sharper, faster.

-

Browse

Opportunities

Explore handpicked, high-potential companies. No clutter - just quality deals backed by research and insight.

Choose & Confirm

Pick your investment amount and hit the buy/sell button to raise an enquiry. Our Relationship Manager will guide you through the next steps.

Complete the Deal

Once payment is done, your shares are transferred securely to your Demat account - usually within 2 business day.

They talk about timing - you just nailed it!

Our

Testimonials

Smart investors don’t guess, they choose AltMoney. Here’s why:

Aiyappan R.

From Chennai, Tamil Nadu

What I liked most was the personal touch. It’s not just an online platform-they actually make sure you understand what you’re investing in

Rajiv C.

From Kolkata, West Bengal

I was skeptical about buying unlisted shares, but seeing how organized and professional AltMoney Vault is, I feel confident about investing more.

Aman G.

From Jaipur, Rajasthan

The team was quick to respond, and the entire process was smoother than I expected. I got my shares without any hassle.

Aiyappan R.

From Chennai, Tamil Nadu

Rajiv C.

From Kolkata, West Bengal

Aman G.

From Jaipur, Rajasthan

Ranjeet S.

From Bangalore, Karnataka

The process was simple, and there were no unnecessary delays. Everything was explained clearly, the shares were transferred in 24 hours

Arvind S.

From Delhi, NCR

I had heard about unlisted shares but never really looked into them. A friend recommended AltMoney Vault, I’m glad I gave it a shot.

Start Your Investment Journey With Us

Fill out the form below and our experts will get back to you.

By submitting this form, you agree to our Terms & Conditions.

Important Financial Security

Alert for Investors

Unlisted investments attract fraud. Stay cautious. Always double-check sources and unofficial contacts.

Important Financial Security Alert for Investors

Alert for Investors

Unlisted investments attract fraud. Stay cautious. Always double-check sources and unofficial contacts.

Real investments carry risk. If someone promises fixed profits, run a few checks on these claims and avoid offers that sound too good to be true.

Only transfer funds to verified company accounts. If unsure, reach out to official channels for confirmation before moving ahead.

Ensure, if someone claims to represent a company, connect directly to their official customer support and verify their details.

Frauds/Scammers may try to close with you quickly. Never rush into investments. Genuine platforms give you time to review and decide.

Every detail is important. Always ask for official proof, timelines, and receipts. If anything seems off, seek help immediately.

Still have Questions?

We’ve got you covered.

Not sure where to start? Don’t worry - we’re here to make things easy. Reach out with your questions, and we’ll walk you through the details patiently.

Still have Questions? We’ve got you covered.

Not sure where to start? Don’t worry - we’re here to make things easy. Reach out with your questions, and we’ll walk you through the details patiently.

Unlisted shares are equity shares of companies that are not listed on any stock exchange, such as the NSE or BSE. These shares are typically traded privately and are less liquid compared to listed shares.

Investors can purchase unlisted shares through private deals with existing shareholders, employee stock option plans, or via intermediaries specializing in unlisted securities.

Yes, unlisted shares are held in demat form, just like listed shares. Since April 1, 2019, it’s mandatory to hold them in dematerialized format.

Capital gains on unlisted shares are divided into short-term and long-term gains.

- If held for over 24 months, gains are considered long-term and taxed at 12.5% without indexation.

- If held for less than 24 months, gains are short-term and taxed as per the investor’s income tax slab rate.

The minimum investment depends on the company and intermediary. It typically ranges between ₹10,000 to ₹50,000.

Unlisted shares have risks like lower liquidity, limited financial disclosures, valuation uncertainty, and regulatory considerations.

Once a company lists, unlisted shares convert into listed ones. However, there is generally a 6-month lock-in period post-listing during which the shares can’t be sold.

Yes, NRIs can invest in unlisted shares, provided they comply with FEMA regulations and complete necessary KYC and documentation.

Unlisted shares can be sold via private off-market deals, facilitated by intermediaries. Transfers are done through demat accounts, and buyer/seller agreement on price is important.

These shares don’t stay unlisted forever.

These shares don’t

stay unlisted forever.

- Fast transactions completed within 48 hours.

- Secure end-to-end encryption and transparency.

- Competitive institutional-grade deals at unmatched value.